Canadian Forces Superannuation Regulations

C.R.C., c. 396

CANADIAN FORCES SUPERANNUATION ACT

Regulations Respecting the Canadian Forces Superannuation

Short Title

1 These Regulations may be cited as the Canadian Forces Superannuation Regulations.

Interpretation

2 In these Regulations,

- Act

Act means the Canadian Forces Superannuation Act; (Loi)

- a(f) Ultimate Table

a(f) Ultimate Table means the table so entitled appearing in the “Mortality of Annuitants 1900-1920” published on behalf of the Institute of Actuaries and the Faculty of Actuaries in Scotland, 1924; (Table a (f) Ultimate)

- Minister

Minister means the Minister of National Defence. (ministre)

3 (1) For the purposes of the definition intermediate engagement in subsection 2(1) of the Act, the duration of the fixed period of service of a member of the regular force shall be 25 years continuous service commencing on the date on which the member was transferred to, enrolled in or re-enrolled in the regular force.

(2) The duration of that period shall be 20 years continuous service commencing when the member was transferred to, enrolled in or re-enrolled in the regular force if the member had completed such a period of service before April 1, 2005, or was serving on such a period of service on that date.

(3) The duration of that period shall be 25 years if, on April 1, 2005, the member was serving on a 20-year continuous period of service commencing when the member was transferred to, enrolled in or re-enrolled in the regular force and the member agrees in writing before the end of that period of service to extend it for an additional five years.

- SOR/78-197, s. 1

- SOR/88-172, s. 1

- SOR/2005–75, s. 1

4 For the purposes of the definition short engagement in subsection 2(1) of the Act, the duration of service shall be continuous service as a commissioned officer in the regular force for a period not exceeding nine years.

- SOR/2001-76, s. 1

5 (1) For the purposes of paragraph 5(2)(c) of the Act, the kind of superannuation or pension benefit therein referred to is one that

(a) is granted under the Judges Act; or

(b) is payable out of the Consolidated Revenue Fund or out of any account or fund in the Consolidated Revenue Fund, other than the Superannuation Account or the Government Annuities Account, and

(i) is related in amount to the period of service that may be counted by the person to whom the superannuation or pension benefit is payable, and

(ii) is payable in instalments during the lifetime of the recipient and thereafter if the superannuation or pension plan so provides.

(2) For the purposes of paragraph 8(2)(a) of the Act, the kind of superannuation or pension benefit therein referred to is one that

(a) is provided in whole or in part as a result of contributions made other than by the contributor;

(b) is related in amount to a period of service; and

(c) is payable in instalments during the lifetime of the recipient and thereafter if the superannuation or pension plan so provides.

- SOR/92-717, s. 10

6 (1) For the purposes of clause 6(b)(ii)(E) of the Act, time of war during the Second World War is the period from September 10, 1939, to September 30, 1947, both dates inclusive.

(2) For the purposes of paragraph 7(1)(g) of the Act, pay on a full-time basis means pay at the rates prescribed by the regulations made under the National Defence Act for officers and men of the regular force and reserve force on Class “C” Reserve Service.

- SOR/83-263, s. 1

- SOR/92-717, s. 10

7 For the purposes of paragraph 18(4)(f) of the Act, the period referred to therein is six months.

- SOR/92-717, s. 10

8 For the purposes of paragraph 23(1)(a) of the Act, in respect of service described in clause 6(b)(ii)(G) of the Act, a theatre of active operations means an area, designated by the Minister from time to time, on the land, sea or in the air, anywhere in or beyond Canada where

(a) in the opinion of the Minister, hostilities were real or apprehended; and

(b) a unit or other element of the Canadian Forces in the area was on active service.

- SOR/92-717, s. 10

Allowances Constituting Part of Pay

9 (1) For the purpose of the definition pay in subsection 2(1) of the Act, commencing the first day of the month following the date on which this subsection comes into force, the monthly allowance that constitutes part of the pay for all ranks is $30.

(2) Subject to paragraph 7(1)(k) of the Act and except as provided in subsection (3), the monthly allowances, which shall constitute part of the pay of rank, shall be, in the case of a period of elective pensionable service performed

(a) prior to September 1, 1946, as prescribed under Part V of the former Act effective September 1, 1946; and

(b) subsequent to August 31, 1946, as prescribed under the Act or Part V of the former Act, as applicable, from time to time during the relevant period.

(3) Subsections (1) and (2) do not apply to an officer who is in receipt of consolidated rates of pay.

(4) [Repealed, SOR/92-717, s. 1]

- SOR/83-263, s. 2

- SOR/92-717, ss. 1, 10

Pensionable Service

Medical Examination

10 Every medical examination required by paragraph 8(2)(b) of the Act shall be

(a) undergone by the contributor within the period of 90 days before or after the making of the election by that person, or within such other period as the Minister may prescribe; and

(b) performed by a medical officer of the Canadian Forces or a civilian medical practitioner acting in that capacity who shall certify whether or not the contributor is disabled.

- SOR/92-717, s. 10

Income Tax Act Compliance

10.1 (1) Notwithstanding Part I of the Act, an election made after August 15, 1997 to count as pensionable service any period of service after December 31, 1989 is void in respect of any service in relation to which the Minister of National Revenue refuses to issue a certification, pursuant to paragraph 147.1(10)(a) of the Income Tax Act, that the conditions prescribed pursuant to that paragraph, as at January 15, 1992, were met in respect of the service after December 31, 1989.

(2) Notwithstanding paragraph 8(2)(a) of the Act, an election made after August 15, 1997 in respect of any service after December 31, 1989 that would be void under that paragraph is void only if, 60 days after being notified by the Minister that the Minister of National Revenue has issued a certification referred to in subsection (1), the elector is entitled to count the service to which the certification relates for the purposes of any superannuation or pension benefit of a kind referred to in subsection 5(2), other than a superannuation or pension benefit payable under Part I of the Act.

(3) Section 45 of the Act does not apply to a person who elects under subsection 43(1) of the Act after August 15, 1997 in respect of service after December 31, 1989 if the Minister of National Revenue refuses to issue the certification referred to in subsection (1).

- SOR/97-255, s. 1

Service Without Pay

11 (1) Any period of service of a contributor in the Canadian Forces of 60 consecutive days or less in respect of which, pursuant to regulations made under the National Defence Act,

(a) a forfeiture has been imposed,

(b) a deduction has been imposed for a period of suspension from duty in an amount equal to the whole of the pay and allowances withheld, or

(c) a forfeiture referred to in paragraph (a) together with a deduction described in paragraph (b) has been imposed,

whether or not he was a contributor during that service and whether or not the service was performed before or after February 1, 1968, shall, to the extent that it may otherwise be counted as pensionable service under the Act, be counted as pensionable service, but any period of such service that exceeds 60 consecutive days shall not be counted as pensionable service.

(2) Any portion of a period of service of a contributor that is three months or less in duration and in respect of which no pay was authorized to be paid, other than any period of service during which a deduction or forfeiture described in paragraph (1)(a), (b) or (c) has been imposed, shall be counted as pensionable service.

(2.1) Where a period of service of a contributor in respect of which no pay was authorized to be paid, other than any period of service during which a deduction or forfeiture described in paragraph (1)(a), (b) or (c) has been imposed, exceeds three months, the portion of the period of service that is in excess of three months shall be counted as pensionable service unless the contributor elects not to count that service as pensionable service.

(2.2) An election not to count as pensionable service a portion of a period of service in excess of three months referred to in subsection (2.1) shall be made by

(a) completing Form CFSA 106 (Surrender of Right to Count Pensionable Service Without Pay) within 90 days after the later of

(i) the end of the period of service, and

(ii) the day on which the contributor is required to resume making contributions under the Act; and

(b) forwarding that form to a commanding officer or other authority designated by the Minister within 30 days after making the election.

(3) Contributions are not required in respect of

(a) any portion of a period of service that exceeds 60 days in duration in respect of which a deduction or forfeiture described in paragraph (1)(a), (b) or (c) has been imposed; or

(b) any service in respect of which an election has been made under subsection (2.1).

(4) During a period of service of a contributor countable as pensionable service under subsection (1), (2) or (2.1), the contributor shall, for the purposes of the Act, be deemed to have been authorized to be paid and to have received pay during that period at the rate of pay authorized for the rank held by the contributor at the commencement of the period.

(5) The contributions required to be paid by a contributor for a period of pensionable service described in subsection (2) or (2.1) shall be paid

(a) by reservation in approximately equal instalments from the contributor’s pay for a period equal to the period of service without pay, commencing on the later of

(i) the day following the day on which the period expires, and

(ii) the day on which the contributor is required to resume making contributions under the Act; or

(b) at the option of the contributor, in a lump sum at any time prior to the completion of payment under paragraph (a).

(5.1) Where a contributor who is paying an amount by instalments pursuant to paragraph (5)(a) commences another period in respect of which no pay is authorized to be paid, other than a period of service during which a deduction or forfeiture described in paragraph (1)(a), (b) or (c) has been imposed, before all instalments have been paid under paragraph (5)(a),

(a) payment of the unpaid instalments is deferred until the later of

(i) the day following the day on which the most recent period of service without pay expires, and

(ii) the day on which the contributor is required to resume making contributions under the Act; and

(b) an amount equal to the aggregate of the amount of the unpaid instalments and the amount payable in respect of the most recent period of service without pay shall be paid in the manner set out in subsection (5), except that the period over which the unpaid instalments were to be paid shall be added to the period of repayment in respect of the most recent period of service without pay.

(6) Any amount payable by a contributor under this section that is unpaid upon his ceasing to be a member of the regular force shall be reserved in the manner prescribed for recovery of unpaid instalments under subsection 14(5).

(7) A contributor who is entitled to count as pensionable service any period of service described in subsection (1), (2) or (2.1) shall contribute to the Superannuation Account in respect of that service an amount equal to the amount that the contributor would have been required to contribute in respect of the pay deemed by subsection (4) to have been authorized to be paid to the contributor during that period

(a) in respect of any portion of a period of service described in subsection (1) that was prior to 1966 or a period of service described in subsection (2) or (2.1), in the manner and at the rate set out in subsection 4(1) of the Act as that subsection read on December 31, 1965;

(b) in respect of any portion of a period of service described in subsection (1) that was after 1965 and prior to April 1, 1969, in the manner and at the rate set forth in subsection 4(1) of the Act as that subsection read on March 31, 1969;

(c) in respect of any portion of a period of service described in subsection (1) that was after March 31, 1969, in the manner and at the rates set out in subsection 5(1) of the Act; and

(d) interest within the meaning of subsection 7(2) of the Act on any amount determined pursuant to any of paragraphs (a) to (c).

(8) A contributor who makes an election under clause 6(b)(ii)(L) of the Act to count as pensionable service any period of service that the contributor had previously elected under subsection (2.1) not to count as pensionable service shall pay to the Superannuation Account an amount equal to

(a) where the election is made within one year after the day on which the contributor is required to resume making contributions under the Act,

(i) the amount that the contributor would have been required to contribute in respect of that period of service had the contributor not made the election, and

(ii) interest within the meaning of subsection 7(2) of the Act; and

(b) in any other case,

(i) the amount that the contributor would have been required to contribute if the rate of pay for that period of service had been the rate of pay in effect at the time of the election under clause 6(b)(ii)(L) of the Act, and

(ii) interest within the meaning of subsection 7(2) of the Act.

- SOR/92-717, s. 10

- SOR/95-569, s. 1

- SOR/95-570, s. 11(F)

11.1 (1) Notwithstanding Part I of the Act, a contributor shall not count as pensionable service any period of service, or any portion of a period of service, in respect of which no pay was authorized to be paid, other than a period of service or portion of a period of service during which a deduction or forfeiture described in paragraph 11(1)(a), (b) or (c) has been imposed, that begins after May 15, 1997 unless compensation can be prescribed in respect of that period or portion of a period pursuant to subsection 8507(2) of the Income Tax Regulations, as that subsection read on January 15, 1992.

(2) A contributor who, by reason of subsection (1), cannot count as pensionable service a period of service, or a portion of a period of service, in respect of which no pay was authorized to be paid

(a) notwithstanding Parts I and III of the Act, is not required to contribute to the Superannuation Account in respect of that period or portion of a period; and

(b) for the purposes of Part II of the Act, remains a participant within the meaning of subsection 60(1) of the Act in respect of that period or portion of a period.

- SOR/97-255, s. 2

12 (1) A contributor who is required under subsection 11(7) or under Part III of the Act to contribute to the Superannuation Account in respect of a period of service referred to in subsection 11(1), (2) or (2.1) shall contribute to that Account in respect of any portion of that period that is after March 31, 1970 the amount that would be required to be contributed under subsection 76(1) of the Act if the period of service were a period of service referred to in that subsection, based on the pay deemed by subsection 11(4) to have been received by the contributor during the period.

(2) An amount payable by a contributor pursuant to subsection (1) shall be paid

(a) where the contribution is in respect of a period of service described in subsection 11(1), by means of a debit to the contributor’s pay account; and

(b) where the contribution is in respect of a period of service described in subsection 11(2) or (2.1), in the manner set out in subsection 11(5).

(3) An amount payable by a contributor under this section that is unpaid

(a) at the time the contributor ceases to be a member of the regular force other than by reason of death, or

(b) at the time of the contributor’s death,

shall be recovered in a manner set out for the recovery of unpaid instalments in subsection 14(5) or (7), as the case may be.

- SOR/83-263, s. 3

- SOR/92-717, s. 10

- SOR/95-569, s. 2

Maximum Pay

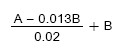

12.1 For the purposes of paragraph 5(2)(d) of the Act, no person shall contribute to the Superannuation Account in respect of any portion of the person’s annual rate of pay that is in excess of the amount determined by the formula

and rounded to the next highest multiple of $100, where

- A

- is

(a) in respect of pay received in 1995, $1,722.22, and

(b) in respect of pay received in any year after 1995, the amount of the defined benefit limit determined for that year pursuant to subsection 8500(1) of the Income Tax Regulations, and

- B

- is the Year’s Maximum Pensionable Earnings for that year determined pursuant to section 18 of the Canada Pension Plan.

- SOR/95-219, s. 1

Revocation of Election

13 (1) An election made by a contributor under the Act to pay for a period of service may, with the approval of the Minister, be revoked by the contributor in whole or in part

(a) as to payments made and to be made for the period of service mentioned in the election, if the contributor received erroneous information, or misleading information in writing, from a member of the regular force or a person employed in the Public Service who normally gives information as to the amount required to be paid under the Act for service, and the contributor, in making the election, honestly acted upon that erroneous or misleading information, or

(b) as to payments to be made for the period of service mentioned in the election, if undue financial hardship, that was unforeseen by the contributor at the time he made the election, may be caused to him if he is required to continue to pay for that period of service,

provided that, where part of a period of service is revoked, only that part that is earliest in point of time may be revoked under this section.

(2) Where an election made by a contributor is revoked under subsection (1) for the reason referred to in paragraph (b) thereof, the contributor shall pay to Her Majesty such amount in respect of any benefit that accrued to him during the subsistence of the election as a consequence of his having elected, as the Minister determines in accordance with Canadian Life Table No. 2 (1941), Males four per cent or Females four per cent, as the case may be.

(3) Any payment made by a contributor under subsection (2) in respect of any benefit accruing to him during the subsistence of an election made under the Act that he revoked under subsection (1) for a reason referred to in paragraph (a) thereof prior to December 4, 1969, shall be refunded to that contributor.

(4) Where an election of a contributor is revoked, in whole or in part pursuant to subsection (1) and the contributor has paid any amount pursuant to the election, the amount so paid shall be applied, firstly, in payment of the amount required to be paid by the contributor under subsection (2), and the remainder of the amount, if any, shall be applied as follows:

(a) if the contributor has revoked the election in whole under paragraph (1)(a), the remainder of the amount shall be refunded to him; and

(b) in any other case, the remainder of the amount shall be applied towards the payment for that portion of the period of service mentioned in the election that has not been revoked, calculated in accordance with the provisions of the Act and these Regulations, and if any of the said amount remains thereafter, it shall be refunded to the contributor.

(5) Where the election of a contributor is revoked in whole or in part pursuant to subsection (1) and further payments are required to be made by him, he shall make those payments in such amount and in such manner as the Minister determines and the payments shall be applied, firstly, in payment of the amount required to be paid by the contributor under subsection (2), if that amount has not already been paid, and the remainder of the payments, if any, shall be applied towards the payment for that portion of the period of service mentioned in the election that has not been revoked, calculated in accordance with the provisions of the Act and these Regulations.

(6) The amount required to be paid by a contributor under subsection (2) may be recovered on behalf of Her Majesty as a debt due to the Crown from any benefit payable under the Act to or in respect of the contributor, without prejudice to any other recourse available to Her Majesty with respect to the recovery thereof.

(7) A request for revocation of an election to pay for service under this section shall be in Form CFSA 107 (Revocation of Election to Pay for Prior Pensionable Service) and shall be forwarded to a commanding officer or other authority designated by the Minister within 30 days of the making thereof.

(8) Where an election to pay for a period of service is revoked by a contributor pursuant to subsection (1), it shall be considered, for the purposes of a future election to pay for that period of service, to be an election as contemplated by clause 6(b)(ii)(K) of the Act.

(9) A contributor may revoke, in whole or in part, an election not to count a period of service as pensionable service under subsection 11(2.1) if the contributor received erroneous or misleading information, in writing, from a member of the Canadian Forces or a person employed in the Public Service whose ordinary duties included the provision of information related to the Act and the contributor acted upon that information in making the election.

- SOR/83-263, s. 4

- SOR/92-717, ss. 8(F), 10

- SOR/95-569, s. 3

- SOR/95-570, s. 12(F)

- SOR/2001-76, s. 2

Manner of Payment for Elective Pensionable Service

14 (1) Where, pursuant to paragraph 9(1)(b) of the Act, a contributor has exercised his option to pay in instalments for pensionable service, those payments shall be made by reservation from pay and allowances or otherwise, for life or for a period of years not greater than for life, and shall be payable in the following manner:

(a) the first instalment shall be due and payable on the first day of the month immediately following the month of election and succeeding instalments monthly thereafter during the term corresponding to the plan of payment selected by the contributor, computed in accordance with Canadian Life Table No. 2 (1941), Males four per cent or Females four per cent, as the case may be; and

(b) he may amend his plan of payment to provide for payment of the instalments still to be paid in a lump sum or by larger monthly instalments on a basis similar to that described in paragraph (a) calculated as of the date of the amendment.

(2) Where a contributor originally exercised his option to pay in one lump sum and subsequent to his election the total amount to be paid in respect of the service for which the contributor elected to pay is verified as a greater amount than that on which the original lump sum payment was based, he shall pay the difference either in one lump sum or by instalments, at his option, on a basis similar to that described in subsection (1).

(3) Where a contributor originally exercised his option to pay by instalments and subsequent to his election the total amount to be paid in respect of the service for which the contributor has elected to pay is verified as a greater or lesser amount than that on which his original instalments were based, the monthly instalment under subsection (1) shall be increased or decreased in accordance with the verified amount, but such instalment shall not be decreased by more than five per cent of the original monthly instalment.

(4) Where a contributor originally exercised his option to pay by instalments for a period of years less than for life and undue financial hardship, which was unforeseen by him at the date of his election, may be caused to him if he is required to continue to pay those instalments, upon the application of that contributor the amount of the monthly instalment may be reduced to an appropriate lesser amount as approved by the Minister on a basis similar to that described in subsection (1), calculated as of the first day of the month following such approval, and every such application shall be made on Form CFSA 105 (Application for Reduction of Instalments), but such application shall be void unless the contributor has passed a medical examination similar to that described in section 10, within the period of 90 days before or after the date of the application or within such other period as the Minister may prescribe.

(5) Where a contributor, who has elected under the Act or Part V of the former Act to pay for any period of service and has undertaken to pay for that period by instalments, ceases to be a member of the regular force before all the instalments have been paid, the unpaid instalments shall be reserved from the benefits payable to him as follows:

(a) subject to paragraph (c), where the benefit payable is an annuity, the remaining instalments shall be reserved from that annuity;

(b) where the benefit payable is a cash termination allowance, the present value of the remaining instalments shall be reserved from that allowance to the extent that such allowance is not reduced below an amount equivalent to a return of contributions; or

(c) where during any period a pension granted under Part V of the former Act or an annuity granted under the Act is not payable or is reduced to an amount that is not sufficient to pay the instalments in full, the unpaid portion of the remaining instalments shall be reserved during such period from the pay and allowances or salary payable to the recipient or from any other amount payable to him by Her Majesty.

(6) Notwithstanding anything contained in this section, a contributor who, pursuant to subsection 9(3) of the Act, elects to surrender his right under subsection 56(2) of the former Act, to defer payment for his prior service in the regular force for which he was not required to pay until the date of his retirement, shall be required to pay the amount prescribed therein in the following manner:

(a) prior to his retirement, the whole or any part of the prescribed amount

(i) in a lump sum without interest, or

(ii) in monthly instalments of any amount without interest,

at his option; and

(b) upon his retirement, any balance remaining of the contributions required to be paid, in the same manner and subject to the same terms and conditions as would be applicable to an amount required to be paid in accordance with subsection 56(2) of the former Act.

(7) For the purpose of subsection 9(4) of the Act, where at the death of a contributor any amount payable by him into the Superannuation Account is due and payable but remains unpaid, the amount payable, with interest at four per cent per annum from the time it became due to the time of his death, shall be recovered from any allowance payable to the survivor or children as follows:

(a) in a lump sum from a cash termination allowance; or

(b) by monthly instalments from an annual allowance in an amount equal to 10 per cent of the net monthly allowance, but in any such case payment may be made by or on behalf of the survivor or children that will liquidate the amount at an earlier date.

- SOR/92-717, s. 10

- SOR/95-570, s. 10(F)

- SOR/2001-76, s. 9

Re-enrolment

15 (1) Subject to subsection (2), where a contributor is retired from the regular force and within 60 days after his retirement therefrom again becomes a member of the regular force, he shall be deemed for the purposes of the Act to have continued to be a member of the regular force notwithstanding his retirement therefrom.

(2) Except where otherwise directed by the Minister, subsection (1) does not apply in any case where a contributor described therein accepts payment at any time, in whole or in part, of a benefit under the Act in respect of such retirement.

(3) Where a contributor, pursuant to subsection (1), is deemed to have continued to be a member of the regular force, he shall be deemed to have continued to receive pay at a rate equal to the rate of pay authorized to be paid to him for the rank held immediately before his retirement.

(4) Where the Minister, pursuant to subsection (2), directs that subsection (1) shall apply, an amount equivalent to the amount of the benefit received shall be recovered by reservation from the pay and allowances of the contributor, or from any other amount payable to him by Her Majesty, in such manner and on such basis as the Minister may prescribe.

Benefits

Vested Right to Benefits After Completing Intermediate Engagement

16 (1) Subject to subsection (2), the immediate annuity to which a contributor is entitled under section 20 of the Act shall be increased by an amount equal to the aggregate of

(a) an amount obtained by multiplying

(i) the number of years of service in the regular force to the credit of the contributor while on an indefinite period of service after completion of an intermediate engagement, divided by 50,

by

(ii) the average annual pay received by the contributor during any five-year period of pensionable service selected by or on behalf of the contributor or during any period so selected consisting of consecutive periods of pensionable service totalling five years, and

(b) an amount equal to the amount by which

(i) an annuity calculated by multiplying

(A) the number of years of pensionable service to the credit of the contributor after having completed an intermediate engagement, divided by 50,

by

(B) the average annual pay received by the contributor during any five-year period of pensionable service, including service in the regular force to the credit of the contributor while on an indefinite period of service after completion of an intermediate engagement, selected by or on behalf of the contributor or during any period so selected consisting of consecutive periods of pensionable service totalling five years

exceeds

(ii) the annuity to which the contributor would have been entitled after having completed the intermediate engagement.

(2) The amount of the increase pursuant to subsection (1) shall, in the case of a contributor who is an officer, be reduced by five per cent of the aggregate of

(a) the annuity to which the contributor would have been entitled under subsection 17(1) of the Act if he had ceased to be a member of the regular force in the circumstances described in that subsection, and

(b) the amount of the increase determined in accordance with subsection (1),

for each full year by which his age at the time of his retirement is less than the retirement age applicable to his rank, except that the amount of the increase shall not be reduced to an amount that is less than the amount determined in accordance with paragraph (1)(b).

(3) The amount of the increase pursuant to subsection (1) shall, in the case of a contributor other than an officer, be reduced by five per cent of the aggregate of

(a) the annuity to which the contributor would have been entitled under subsection 17(1) of the Act if he had ceased to be a member of the regular force in the circumstances described in that subsection, and

(b) the amount of the increase determined in accordance with subsection (1)

for each full year by which his age at the time of his retirement is less than the retirement age applicable to his rank or for each full year by which his period of service in the regular force is less than 25 years, whichever is the lesser, except that the amount of the increase shall not be reduced to an amount that is less than the amount determined in accordance with paragraph (1)(b).

- SOR/78-197, s. 2

- SOR/80-123, s. 1

- SOR/92-717, s. 10

- SOR/99-340, s. 1

Payments to Survivor and Children

17 (1) For the purposes of subsection 31(2) of the Act, where a child was born to a person at a time when that person was over 60 years of age, and after that time, that person did not become or continue to be a contributor, the child is not entitled to an allowance under the Act unless it appears to the Minister that the child was born following a gestation period commencing prior to the date when the contributor attained the age of 60 years or ceased to be a member of the regular force, whichever is the later.

(2) [Repealed, SOR/92-717, s. 2]

- SOR/92-717, ss. 2, 10

18 (1) For the purpose of paragraph 25(4)(b) of the Act, full-time attendance at a school or university means full-time attendance at a school, college, university or other educational institution that provides training or instruction of an educational, professional, vocational or technical nature and a child shall be deemed to be or to have been in full-time attendance at a school or university substantially without interruption

(a) during an absence by reason of a scholastic vacation,

(i) if immediately after such vacation he begins or resumes full-time attendance at a school or university in the next ensuing academic year,

(ii) where it is determined by the Chief of the Defence Staff that the child cannot comply with subparagraph (i) by reason of illness or any other cause that the Chief of the Defence Staff considers reasonable, if he begins or resumes full-time attendance at a school or university at any time during the academic year immediately following the scholastic vacation, or

(iii) where it is determined by the Chief of the Defence Staff that the child cannot comply with subparagraph (ii) by reason of illness or any other cause, if he begins or resumes such full-time attendance at the first opportunity, as determined by the Chief of the Defence Staff, following the illness or other cause; and

(b) during an absence occurring in an academic year by reason of illness or any other cause that the Chief of the Defence Staff considers reasonable, if immediately after such absence he begins or resumes full-time attendance at a school or university in that academic year or, where it is determined by the Chief of the Defence Staff that the child is unable to do so, if he begins or resumes such full-time attendance at the first opportunity, as determined by the Chief of the Defence Staff, following the illness or other cause that led to the absence.

(2) Where a child’s absence by reason of illness commences after he has begun an academic year and it is determined by the Chief of the Defence Staff, on evidence satisfactory to him, that by reason of such illness it is not possible for the child to resume full-time attendance at a school or university, that child shall, notwithstanding paragraph (1)(b), be deemed to have been in full-time attendance substantially without interruption at a school or university until the end of that academic year.

(3) Where the death of a child occurred while he was absent from school or university by reason of illness or any other cause that the Chief of the Defence Staff considers reasonable, that child shall, notwithstanding subsection (1), be deemed to have been in full-time attendance substantially without interruption at a school or university

(a) until his death, where it occurred during the academic year in which his absence commenced; or

(b) until the end of the academic year in which his absence commenced, where his death occurred after that academic year.

(4) Where a child ceases to be a child, as defined in paragraph 25(4)(b) of the Act, while he is absent

(a) during an academic year by reason of illness or any other cause that the Chief of the Defence Staff considers reasonable, or

(b) during a scholastic vacation,

that child shall, notwithstanding subsection (1), be deemed to have been in full-time attendance at a school or university substantially without interruption until the end of the month in which he ceased to be a child if, immediately after such absence,

(c) in the case of an absence referred to in paragraph (a), he begins or resumes such full-time attendance at a school or university in that academic year or where it is determined by the Chief of the Defence Staff that that child is unable to do so, he begins or resumes such full-time attendance in the next ensuing academic year; or

(d) in the case of an absence referred to in paragraph (b), he begins or resumes such full-time attendance at a school or university in the next ensuing academic year.

- SOR/92-717, s. 10

19 There shall be submitted to the Chief of the Defence Staff in support of each claim that a child of 18 or more years of age

(a) is or has been enrolled in a course requiring full-time attendance substantially without interruption at a school or university, a declaration in a form satisfactory to the Chief of the Defence Staff and signed by a responsible officer of that school or university certifying to that enrolment; and

(b) is or has been for a period of time in full-time attendance at a school or university substantially without interruption, a declaration of that attendance in a form satisfactory to the Chief of the Defence Staff and signed by that child.

Limit on Child’s Entitlement

19.1 Notwithstanding subsection 25(4) of the Act, a child of a contributor who dies after May 15, 1997 is not entitled to an annual allowance under section 25 of the Act unless, at the time of the contributor’s death, the child was dependent on the contributor for support.

- SOR/97-255, s. 3

Limits on Survivors’ Benefits

19.2 (1) The monthly amount payable to a survivor or child under section 25 of the Act, in respect of pensionable service after December 31, 1991 of a deceased contributor described in paragraph 8503(2)(d) of the Income Tax Regulations, in the circumstances described in subparagraphs 8503(2)(d)(i) to (iii) of those Regulations, shall not exceed the maximum amount of survivor retirement benefits that may be paid for each month to the beneficiary of a member, determined under subparagraph 8503(2)(d)(iv) of the those Regulations, as that paragraph and those subparagraphs read on January 15, 1992.

(2) The aggregate of all monthly amounts payable to survivors and children under section 25 of the Act, in respect of pensionable service after December 31, 1991 of a deceased contributor described in paragraph 8503(2)(d) of the Income Tax Regulations, in the circumstances described in subparagraphs 8503(2)(d)(i) to (iii) of those Regulations, shall not exceed the maximum amount of survivor retirement benefits that may be paid for each month to the beneficiaries of a member, determined under subparagraph 8503(2)(d)(v) of those Regulations, as that paragraph and those subparagraphs read on January 15, 1992.

(3) Subject to subsection (5), the monthly amount payable to a survivor or child under section 25 of the Act in respect of pensionable service after December 31, 1991 of a deceased contributor described in paragraph 8503(2)(e) of the Income Tax Regulations, in the circumstances described in subparagraphs 8503(2)(e)(i) to (iv) of those Regulations, shall not exceed the maximum amount of survivor retirement benefits that may be paid for each month to a beneficiary of a member, determined under subparagraph 8503(2)(e)(v) of those Regulations, as that paragraph and those subparagraphs read on January 15, 1992.

(4) The aggregate of all monthly amounts payable to survivors and children under section 25 of the Act in respect of pensionable service after December 31, 1991 of a deceased contributor described in paragraph 8503(2)(e) of the Income Tax Regulations, in the circumstances described in subparagraphs 8503(2)(e)(i) to (iv) of those Regulations, shall not exceed the maximum amount of survivor retirement benefits that may be paid for a month to the beneficiaries of a member, determined under subparagraph 8503(2)(e)(vi) of those Regulations as that paragraph and those subparagraphs read on January 15, 1992.

(5) The present value of all benefits payable to a survivor under section 25 of the Act in respect of pensionable service after December 31, 1991 of a deceased contributor described in paragraph 8503(2)(f) of the Income Tax Regulations, in the circumstances described in subparagraphs 8503(2)(f)(i) to (iv) of those Regulations, as that paragraph and those subparagraphs read on January 15, 1992, calculated as at the time of the contributor’s death, shall not exceed the present value, as at the time immediately before the contributor’s death, of all benefits that have accrued under that section with respect to the contributor to the day of the contributor’s death.

(6) The limits set out in subsections (1) to (5) apply to amounts payable with respect to a contributor who dies after the coming into force of an order, made under paragraph 10(a) of the Special Retirement Arrangements Act in respect of a person referred to in subparagraph 10(a)(ii) or (vi) of that Act, providing for the payment of benefits to the survivor or children of the contributor.

- SOR/97-255, s. 3

- SOR/2001-76, s. 3

Evidence Required to Satisfy the Minister Under Paragraph 15(2)(b) of the Act

20 (1) The evidence required to satisfy the Minister that a contributor has not become entitled to a disability pension described in paragraph 15(2)(b) of the Act shall be

(a) a document signed by the contributor stating that he has not become entitled to a disability pension payable under paragraph 44(1)(b) of the Canada Pension Plan or a similar provision of the Quebec Pension Plan; and

(b) a certificate signed by or on behalf of the Minister charged with the administration of the Canada Pension Plan or the President of the Quebec Pension Board, whichever is appropriate, certifying that the contributor named therein has not become entitled to a disability pension payable under paragraph 44(1)(b) of the Canada Pension Plan or a similar provision of the Quebec Pension Plan.

(2) A contributor who is a member of the Canadian Forces on June 10, 1976, and who subsequently ceases to be a member of the Canadian Forces shall provide the evidence referred to in paragraph (1)(a) prior to the date on which the contributor is entitled to an annuity under the Act.

(3) Subject to subsection (4), a contributor who ceases to be a member of the Canadian Forces prior to June 10, 1976, shall provide the evidence set out in paragraph (1)(a) within six months of the date on which he is notified by the Minister in writing of the requirements of paragraph 15(2)(b) of the Act.

(4) The Minister may extend the time prescribed by subsection (3) where he is of the opinion that the contributor was, owing to circumstances beyond the contributor’s control, unable to provide the evidence referred to in paragraph (1)(a) within the period of time prescribed in that subsection.

- SOR/92-717, s. 10

21 [Repealed, SOR/2001-76, s. 4]

Payments Otherwise than by Monthly Instalments

22 For the purposes of subsections 11(1) and (2) of the Act, where a person in receipt of an annuity or annual allowance requests that it be paid otherwise than in equal monthly instalments, or where the payment of an annuity or annual allowance in equal monthly instalments is not practicable for administrative reasons, the Minister may direct, if such direction does not result in the payment of an aggregate amount greater than the aggregate amount of equal monthly instalments otherwise payable in accordance with the said subsections, that the annuity or annual allowance shall be paid in arrears

(a) in equal instalments quarterly or semi-annually; or

(b) annually.

- SOR/86-1079, s. 1

- SOR/92-717, s. 10

Deemed Re-enrolment — Election to Repay

22.1 (1) A person shall make an election under subsection 41(4) of the Act by completing Form CFSA 100 and forwarding that form to the person’s commanding officer or to any other person designated by the Minister.

(2) A person who makes an election under subsection 41(4) of the Act shall pay the amount payable under that subsection in a lump sum within 30 days after receipt of notification from the Minister of the amount due.

- SOR/95-570, s. 1

- SOR/2001-76, s. 5(F)

Revocation of Option

23 Subject to section 24, where a contributor has exercised an option under sections 17 to 19 of the Act or has been deemed to have exercised an option under that section, he may, with the consent of the Minister, revoke the option and exercise a new option if the contributor received from a member of the Canadian Forces or a person employed in the Public Service who normally gives information as to the benefits in respect of which the contributor may be entitled to exercise an option upon ceasing to be a member of the regular force erroneous information or misleading information in respect of

(a) the amount, nature or type of any such benefit; or

(b) the procedures required to be followed to constitute a valid exercise of an option.

- SOR/92-717, s. 10

24 No option referred to in sections 17 to 19 of the Act may be revoked and no new option under that section of the Act may be exercised under section 23 unless

(a) the contributor applies to the Minister to revoke the option and to exercise a new option within three months of the day upon which he became aware that erroneous or misleading information was given to him or, in the case of a contributor who ceased to be a member of the regular force prior to June 10, 1976, within such period as the Minister may fix;

(b) the contributor

(i) in the case of the exercise by him of the option under sections 17 to 19 of the Act, acted on the erroneous or misleading information referred to in section 23 in exercising the option and would have made a different choice of benefit under the Act or exercised his option at an earlier time had no erroneous or misleading information been given, or

(ii) in the case of the deemed exercise by him of the option under section 10 of the Act, refrained, as a result of the erroneous or misleading information referred to in section 23, from exercising an option under section 10 of the Act and would have exercised his option in favour of a benefit other than the benefit in favour of which he was deemed to have exercised his option had no erroneous or misleading information been given; and

(c) subject to section 26, any payment made to the contributor in respect of any benefit accruing to him during the subsistence of the option that he made under sections 17 to 19 of the Act or was deemed to have made under that section is repaid by the contributor within 30 days of being notified by the Minister of the amount of the payment to be repaid.

- SOR/86-1079, s. 2

- SOR/92-717, s. 10

25 Where the Minister consents to the revocation of an option and the exercise of a new option under section 23, the new option shall be effective on the date that the previous option was exercised or was deemed to have been exercised under the Act unless the Minister otherwise prescribes.

26 Where the new option exercised by the contributor under section 23 results in the payment of an annuity and in the opinion of the Minister the repayment by the contributor of the payment referred to in paragraph 24(c) within the period specified in that paragraph would cause undue financial hardship to the contributor, the amount of the payment shall be repaid in monthly instalments in such amounts as the Minister directs to be withheld from the annuity payable pursuant to the new option and such deductions shall not in any case be less than 10 per cent of the gross monthly amount of such annuity.

Debit Balances in Pay Accounts

27 For the purposes of section 53 of the Act, any debit balance in the pay account of a former member of the regular force shall be recovered

(a) from any return of contributions or cash termination allowance to which he is entitled, in a lump sum; or

(b) from any annuity to which he is entitled, by monthly instalments in an amount equal to 10 per cent of his net monthly annuity, or by monthly instalments in an amount equal to such greater percentage of the net monthly annuity, not exceeding 50 per cent, as may be fixed by the Minister, where the debit balance has resulted directly or indirectly from

(i) the theft or fraudulent obtaining of public or non-public funds by the former member, or

(ii) an overpayment of pay and allowances that the former member fraudulently obtained or knowingly accepted.

- SOR/92-717, s. 10

Recovery of Amounts Paid in Error

28 (1) Where an amount has been paid in error under Part I of the Act to a person on account of any annuity or annual allowance and the Minister directs that the amount be repaid by way of deductions from any subsequent payments of that annuity or annual allowance, that person shall forthwith be notified of the amount that has been paid in error and the manner in which the amount is to be recovered.

(2) The amount referred to in subsection (1) shall be recovered by monthly instalments deducted from any annuity or annual allowance payable to that person for a period equal to the lesser of

(a) the life expectancy of that person, and

(b) the period required to pay the amount in monthly instalments equal to 10 per cent of the gross monthly amount of the annuity or annual allowance

calculated as of the date of the Minister’s direction, in accordance with Canadian Life Table Number 2 (1941), Males or Females, as the case may be.

29 A person from whose annuity or annual allowance deductions are being made pursuant to section 28 may, at any time, pay the amount then owing

(a) in a lump sum;

(b) by larger monthly instalments on a basis similar to that described in subsection 28(2); or

(c) by a lump sum payment and by monthly instalments on a basis similar to that described in subsection 28(2) and payable within the same or a lesser period than that originally set out.

30 Where, pursuant to subsection 28(2), deductions are to be made from the annuity or annual allowance of a person by monthly instalments, the first deduction therefrom shall be made in the month in which the Minister specifies, and succeeding deductions shall be made thereafter in equal amounts, except with respect to the last deduction which may be less in amount than the preceding deductions.

31 Notwithstanding subsection 28(2), where deductions by monthly instalments referred to therein would, in the opinion of the Minister, cause financial hardship to the person to whom the annuity or annual allowance is payable, the Minister may direct that lesser monthly instalments be deducted, but such instalments shall not in any case be less than five per cent of the gross monthly amount of annuity or annual allowance, or $1, whichever is the greater.

32 Where the Minister directs, pursuant to section 31, that lesser deductions be made, and where the person in respect of whom the lesser deductions are being made dies before the amount is paid in full, the amount remaining unpaid shall, if the Minister so directs, be retained from any further benefits payable under the Act in respect of that person.

- SOR/86-1079, s. 3(F)

Estate Tax and Succession Duties

33 (1) Where, upon the death of a contributor, any annual allowance becomes payable under the Act to a successor, application in writing may be made, by or on behalf of the successor, to the Minister for payment out of the Superannuation Account of the whole or any part of such portion of any estate, legacy, succession or inheritance duties or taxes payable by the successor that are attributable to the said allowance, and where the Minister directs, in accordance with the application, that the whole or any part of the duties or taxes so payable shall be paid out of the Superannuation Account, the maximum portion of the said duties or taxes that may be paid is the proportion that

(a) the value of the allowance payable to the successor

is of

(b) the value of the whole estate,

calculated for the purposes of determining the said duties or taxes payable in respect thereof.

(2) Where the Minister gives a direction in accordance with subsection (1), if the annual allowance payable to the successor is payable in equal, monthly, quarterly or semi-annual instalments or in an annual amount, the allowance shall be reduced either for a term requested by the successor in the application made under subsection (1), or during the entire period for which the allowance is payable if the successor fails to make a request in the application under subsection (1) that the allowance be reduced for a term,

(a) where the allowance is payable in monthly instalments, by 1/12 of an amount,

(b) where the allowance is payable in quarterly instalments, by 1/4 of an amount,

(c) where the allowance is payable in semi-annual instalments, by 1/2 of an amount, and

(d) where the allowance is payable annually, by the whole of an amount,

determined by dividing the amount of the said duties or taxes to be paid out of the Superannuation Account by the value of an annuity of $1 per annum, payable monthly, quarterly, semi-annually or annually, as the allowance is payable, to a person of the age of the successor at the date of payment of the said duties or taxes out of the Superannuation Account, calculated

(e) in the case of an allowance payable to the survivor of the contributor, in accordance with a(f) Ultimate Table, together with interest at the rate of four per cent per annum; and

(f) in the case of an allowance payable to a child of the contributor, at an interest rate of four per cent per annum and mortality shall not be taken into account.

(3) Where the annual allowance of a successor was reduced under this section for a term and the annual allowance was suspended before the end of the term under section 27 of the Act as it read on June 28, 1989, if at any time the annual allowance is resumed it shall be reduced for a term equal to the term or the balance of the term, as the case may be, during which the annual allowance would have been reduced had it not been suspended and such reduction shall be made to the same extent and in the same manner as the annual allowance was reduced immediately prior to the suspension.

- SOR/2001-76, ss. 6, 9

Canada Pension Plan

34 For the purposes of subsection 2(4) of the Act, the following employment as a member of the Canadian Forces is excepted employment for the purposes of the Canada Pension Plan:

(a) employment on or after January 1, 1966, as a member of the Canadian Forces to whom the Defence Services Pension Continuation Act applies; and

(b) employment on or after January 1, 1966, as an officer or man in the reserve forces or the reserve force to whom the Queen’s Regulations and Orders for the Canadian Forces apply, other than employment

(i) on Continuous Duty or Class “C” Reserve Service, or

(ii) in excess of 30 days on Special Duty or Class “B” Reserve Service.

General

35 The chairman of the Service Pension Board may issue such instructions and prescribe such forms as he deems necessary to give effect to section 49 of the Act.

- SOR/92-717, s. 10

36 (1) For the purposes of paragraph 55(1)(b) of the Act, interest shall be calculated in respect of each quarter in each fiscal year as of the last day of June, September, December and March on the balance to the credit of the Superannuation Account on the last day of the preceding quarter.

(2) The rate to be used for the purpose of calculating interest under subsection (1) in respect of any quarter is the rate that would yield an amount of interest equal to the amount of interest that the aggregate of the balances to the credit of the Superannuation Accounts maintained under the Public Service Superannuation Act, the Canadian Forces Superannuation Act and the Royal Canadian Mounted Police Superannuation Act would have yielded during that quarter if the quarterly excess were invested at,

(a) where the rate is to be used in respect of any quarterly excess after December 31, 1965, the average of the rates of interest that may be or have been determined by the Minister of Finance for the months in that quarter pursuant to subsection 111(2) of the Canada Pension Plan; and

(b) where the rate is to be used in respect of any quarterly excess before the quarter ending on March 31, 1966, the average of the rates of interest determined by the Minister of Finance for the months in that quarter as if subsection 111(2) of the Canada Pension Plan had been in force.

(3) The President of the Treasury Board shall cause notice of the rate to be used in respect of each fiscal year for the purpose of calculating interest under subsection (1) to be published in the Canada Gazette.

(4) In this section, quarterly excess means

(a) the total of the amounts credited to the Superannuation Accounts maintained under the Public Service Superannuation Act, the Canadian Forces Superannuation Act and the Royal Canadian Mounted Police Superannuation Act during any quarter of a fiscal year

minus

(b) the payments charged to those Accounts during that quarter

plus

(c) the total of any amounts credited to those Accounts less the payments charged to those Accounts during any quarter of a fiscal year that is a multiple of 20 years prior to the quarter referred to in paragraph (a).

- SOR/92-717, ss. 3, 10

- SOR/2001-131, s. 2(F)

Calculation of Interest on Return of Contributions for Any Period before 2001

36.1 (1) In this section, 1973 closing balance means the aggregate of all amounts referred to in paragraphs (a) and (b) of the definition return of contributions in section 10 of the Act that have been paid by the contributor into, or transferred to the credit of the contributor to, the Superannuation Account before January 1, 1974 and that have not been previously paid to the contributor as a return of contributions.

(2) In this section, yearly contribution means the aggregate of all amounts referred to in paragraphs (a) and (b) of the definition return of contributions in section 10 of the Act that have been paid by the contributor into, or transferred to the credit of the contributor to, the Superannuation Account or the Canadian Forces Pension Fund during a calendar year and that have not been previously paid to the contributor as a return of contributions.

(3) For the purposes of paragraph 13(a) of the Act, for any period before January 1, 2001, interest shall be calculated on

(a) the 1973 closing balance, from January 1, 1974, to the earlier of December 31 of the year immediately preceding the year in which the contributor ceased to be a member of the regular force and December 31, 2000; and

(b) each yearly contribution after 1973, from January 1 of the year following the year in which the contribution was made to the earlier of December 31 of the year immediately preceding the year in which the contributor ceased to be a member of the regular force and December 31, 2000.

- SOR/2001-131, s. 1

Calculation of Interest on Return of Contributions for Any Period after 2000

36.2 (1) In this section, 2000 closing balance means the aggregate of all amounts referred to in paragraphs (a) and (b) of the definition return of contributions in section 10 of the Act that have been paid by the contributor into, or transferred to the credit of the contributor to, the Superannuation Account or the Canadian Forces Pension Fund before January 1, 2001 and that have not been previously paid to the contributor as a return of contributions, plus interest on that aggregate amount calculated in accordance with section 36.1.

(2) For the purposes of paragraph 13(b) of the Act, for any period after December 31, 2000, interest shall be calculated and balances determined in accordance with this section and interest shall be calculated in respect of every quarter up to and including the quarter preceding the quarter in which the return of contributions is paid.

(3) For the quarter ending March 31, 2001,

(a) if a return of contributions is paid during that quarter, interest shall be calculated and the balances determined in accordance with section 36.1; and

(b) in any other case, interest shall be calculated at the effective quarterly rate determined from an annual rate of four per cent on the 2000 closing balance.

(4) For each quarter beginning after March 31, 2001 for which interest is being calculated, interest shall be calculated at the rate determined under subsections (5) and (6) for that quarter on

(a) the 2000 closing balance;

(b) the interest calculated in accordance with paragraph (3)(b) on the 2000 closing balance;

(c) the aggregate of all amounts referred to in paragraphs (a) and (b) of the definition return of contributions in section 10 of the Act that have been paid by the contributor into, or transferred to the credit of the contributor, to the Canadian Forces Pension Fund after December 31, 2000 but before the end of the quarter preceding the quarter for which interest is being calculated and that have not been previously paid to the contributor as a return of contributions; and

(d) interest calculated in accordance with this subsection as of the end of the quarter preceding the quarter for which interest is being calculated.

(5) The rate of interest to be used for the purposes of subsection (4) is the effective quarterly rate determined from the annual rate of return of the Canadian Forces Pension Fund published in the previous fiscal year’s annual report for the Public Sector Pension Investment Board as laid before each House of Parliament under subsection 48(3) of the Public Sector Pension Investment Board Act.

(6) If the rate of return referred to in subsection (5) is negative, the rate of interest shall be zero per cent.

- SOR/2001-131, s. 1

Annual Report

36.3 Beginning with the fiscal year ending March 31, 2002, the annual report referred to in section 57 of the Act shall include the financial statements of the pension plan provided by the Act, prepared in accordance with the federal government’s stated accounting policies for the pension plan, which are based on generally accepted accounting principles.

- SOR/2003-14, s. 1

Capitalized Value

37 Where, pursuant to Part I of the Act, it is necessary to determine the capitalized value of an annuity or annual allowance, the capitalized value shall be computed on the basis of the Canadian Life Table Number 2 (1941), Males or Females, as the case may be, together with interest at the rate of four per cent per annum.

Forms

38 (1) The following forms are prescribed for the purposes of the applicable sections of the Act referred to below:

(a) Form CFSA 100 (Election to Pay for Prior Pensionable Service/Election to Repay Annuity or Pension Drawn during a Period of Elective Service) — paragraph 6(b) and subsections 41(4), 42(1) and 43(1) of the Act;

(b) Form CFSA 102 (Election to Surrender Right to Pay on Retirement for Non-Contributory Regular Force Service) — subsection 9(3) of the Act;

(c) Form CFSA 103 (Election to Surrender Annuity or Annual Allowance under Public Service Superannuation Act or Royal Canadian Mounted Police Superannuation Act) — subsection 46(2) of the Act.

(2) The following forms are prescribed for the purposes of the applicable sections of these Regulations referred to below:

(a) Form CFSA 105 (Application for Reduction of Instalments) — subsection 14(4);

(b) Form CFSA 106 (Surrender of Right to Count Non-Elective Pensionable Service) — subsection 11(2);

(c) Form CFSA 107 (Revocation of Election to Pay for Prior Pensionable Service) — subsection 13(7).

- SOR/92-717, s. 10

- SOR/95-570, ss. 2, 8 to 12(F)

Transitional

39 For the purposes of paragraph 50(l) of the Act, any direction given by the Minister under subsection 62(1) of the former Act which is outstanding on February 1, 1968, shall continue to have full force and effect in the circumstances contemplated by that subsection but any such direction shall be subject to modification or suspension by the Minister on receipt of a recommendation from the Canadian Pension Commission.

- SOR/92-717, s. 10

Canadian Forces Supplementary Death Benefits

Contributions

40 (1) The contributions required to be paid by every participant shall be paid monthly by reservation from pay and allowances or otherwise, as specified in these Regulations.

(2) [Repealed, SOR/92-717, s. 4]

- SOR/92-717, s. 4

Participants Absent from Duty

41 The contribution required to be paid by a participant who is absent from duty is an amount equal to the amount that he would be required to pay if he were not so absent.

42 Where a participant is absent from duty with leave and receives pay and allowances during the period when he is so absent, the contributions required to be paid by him shall, during the period when he is absent, be paid in accordance with section 41.

43 (1) Where a participant is absent from duty with leave but does not receive pay and allowances for or in respect of the period, or any part thereof, during which he is so absent, he shall pay the contributions required to be paid by him at such times and in such manner as the Minister, from time to time, prescribes, and any part of the contributions not paid during his absence shall be paid by that participant when he returns to duty by reservation from pay and allowances in accordance with subsection (2).

(2) Where a participant returns to duty after having been absent from duty with leave and has not paid the contributions required to be paid by him in respect of the period, or any part thereof, during which he was so absent, the appropriate amount of contributions shall be recovered by monthly deductions from his pay account during a period of not more than six months in amounts not less than amounts that were required to be paid by him while he was so absent, except that, in exceptional circumstances, the Minister, in his discretion, may extend the period during which the contributions shall be recovered.

(3) Notwithstanding anything in this section, where a participant who has been absent from duty with leave and has returned to duty is paying the appropriate amount of contributions in respect of a period when he was so absent by reservation from his pay and allowances, he may pay, in one lump sum, at any time prior to the expiration of the period during which the contributions are to be recovered from pay and allowances, the amount payable by him in respect of the period during which he was so absent.

- SOR/95-570, s. 4(F)

44 Where a participant is absent without authority for a period in excess of 21 consecutive days, he shall be deemed to have ceased to be a member of the regular force on the last day in the month in which the 22nd consecutive day on which he was so absent occurs, unless such absence ceases on or before the last day of the said month.

Elective Participants

45 (1) Subject to subsections (2) and (3), every elective participant, other than a participant who has made an election under section 64 of the Act, who, on ceasing to be a member of the regular force, is entitled to an immediate annuity under Part I of the Act, shall contribute $0.05 each month for every $250 of the salary of the participant at the time the participant ceases to be a member.

(2) The salary in respect of which a contribution is calculated under subsection (1) is reduced by 10 per cent for each year in excess of 60 years of age that is attained by the participant, except that such a reduction may not reduce the salary to less than $2,500.

(3) The contribution required under subsection (1) in respect of a participant who is 65 years of age or older is reduced by $0.50 per month, effective on the later of

(a) December 1, 1992, and

(b) the April 1 or October 1 that follows the day on which the participant attains 65 years of age, whichever is earlier.

(4) Subject to subsection (5), a participant who contributed under subsection (1) during the period beginning on October 5, 1992 and ending on November 30, 1992 shall, in respect of the period beginning on December 1, 1992 and ending on March 31, 1993, contribute one half of the amount determined under subsection (1).

(5) The contribution required under subsection (4) is reduced by $0.25 per month in respect of a participant who attained 65 years of age before October 1, 1992.

(6) An elective participant who, on ceasing to be a member of the regular force, is entitled to an immediate annuity under Part I of the Act and who makes an election under section 64 of the Act shall contribute $0.50 per month until the participant attains 65 years of age.

(7) Every elective participant who, on ceasing to be a member of the regular force, was not or is not entitled to an immediate annuity under Part I of the Act, shall contribute, for every $2,000 of the basic benefit of the participant

(a) during any period in which neither an annuity under Part I of the Act nor a pension under the Defence Services Pension Continuation Act is payable to the participant, the amount set out in Part I of Schedule I; and

(b) during any period in which an annuity under Part I of the Act or a pension under the Defence Services Pension Continuation Act is payable to the participant, the amount set out in Part II of Schedule I.

(8) An elective participant referred to in subsection (7), other than a participant who made an election under section 64 of the Act, who, during the period beginning on October 5, 1992 and ending on November 30, 1992, paid monthly contributions in accordance with Schedule I, shall, in respect of the period beginning on December 1, 1992 and ending on March 31, 1993, contribute one half of the amount set out in Part II of Schedule I.

(9) Contributions payable under paragraph (7)(a) shall be paid in a lump sum, in advance,

(a) in respect of a participant who ceased to be a member of the regular force before November 1, 1992, each year on or before the thirtieth day after the anniversary of the day on which the participant ceased to be a member of the regular force; and

(b) in respect of a participant who ceases to be a member of the regular force on or after November 1, 1992, on or before the thirtieth day after the day on which the participant ceases to be a member of the regular force and, in each succeeding year, on or before the thirtieth day after the anniversary of the day on which the participant ceased to be a member of the regular force.

(10) Where the consent of the Treasury Board is required before an annuity may be paid under the Act, or before a pension may be paid under the Defence Services Pension Contribution Act, to an elective participant and the Treasury Board does not consent,

(a) the first contribution payable under paragraph (7)(a) is payable by the participant on the thirtieth day after the day of the Treasury Board decision; and

(b) each subsequent contribution is payable by the participant on the thirtieth day after the anniversary of the day on which the participant ceased to be a member of the regular force.

(11) Contributions payable under subsections (1), (4) and (6) and paragraph (7)(b) shall be paid by reservation from the annuity or pension referred to in those subsections or that paragraph, as the case may be.

(12) Where a person who is an elective participant has paid a contribution under Part II of the Act in respect of a period longer than one month and, before the expiration of that period, the person becomes, under the Act or under Part II of the Public Service Superannuation Act, a participant other than an elective participant, there shall be refunded to the participant an amount equal to the fraction of the last contribution paid, of which

(a) the numerator is the number of complete calendar months remaining until the participant’s next contribution would have been payable if the participant had continued to be an elective participant; and

(b) the denominator is the total number of calendar months in respect of which the contribution was paid by the participant.

- SOR/92-717, s. 5

Recoveries

46 (1) Where a participant ceases to be a member of the regular force and does not become a Public Service participant, any contributions payable by him on the day he ceases to be a member of the regular force may be recovered in one lump sum, or by instalments, from any moneys payable to or in respect of him at any time by or on behalf of Her Majesty.

(2) Where an elective participant dies, any contributions payable by him on the day of his death may be recovered from any moneys payable to or in respect of him at any time by or on behalf of Her Majesty.

- SOR/92-717, ss. 8(F), 9(F)

- SOR/95-570, s. 4(F)

Service Substantially Without Interruption

47 Where, during any relevant period, a person ceases to be a member of the regular force and within three months from the day on which he so ceases to be a member he again becomes a member of that force, his service in the regular force during that period shall, for the purposes of Part II of the Act, be deemed to be substantially without interruption.

Retroactive Increases in Pay

48 For the purpose of Part II of the Act, where a retroactive increase is authorized in the pay of a participant, such increase shall be deemed to have commenced to have been received by him on the first day of the month in which

(a) the Governor in Council or the Treasury Board, as appropriate, approved such increase; or

(b) written approval of such increase was duly issued by the appropriate authority in a case where approval of the Governor in Council or the Treasury Board is not required.

Proof of Age

49 (1) For the purposes of Part II of the Act, proof of age shall, subject to subsection (2), be established by the following evidence:

(a) a birth certificate issued by an appropriate civil authority;

(b) a baptismal certificate, issued by an appropriate religious authority, indicating that the baptism took place within five years after the date of birth; or

(c) an official notification issued by an appropriate civil authority indicating that the birth is registered with that authority and stating therein the date of birth.

(2) In the event that the evidence referred to in subsection (1) cannot be obtained by the participant, proof of his age may be established by

(a) a document made within five years of the date of birth of the participant showing his name and date of birth or his age, or a certified copy or extract thereof;

(b) a document, or a certified copy or extract thereof, showing the name and date of birth or age of the participant, that is at least 20 years old at the time that it is considered by the Minister for the purpose of establishing the age of the participant, and that, except where the document is a page from the Family Bible, is wholly or partly in print; or

(c) one of each or two of either of the following documents, showing the name and date of birth or age of the participant, and that agree as to the month and year of his birth, or certified copies or extracts thereof, namely,

(i) an affidavit or statutory declaration made by a parent, brother or sister of the participant, or some other person having knowledge of the pertinent facts of his birth, or

(ii) a document at least 10 years old at the time that it is considered by the Minister for the purpose of establishing the age of the participant;

(d) evidence relating to the inability to obtain either of the certificates referred to in subsection (1) in the form of

(i) a letter from an appropriate authority indicating that a search has been made for a certificate of birth but that such search was unsuccessful, or

(ii) a statement that satisfies the Minister as to why it would not be practical to conduct a search for any of the documents referred to in subsection (1); and

(e) a statement, in a form prescribed by the Minister, attesting to the validity of the evidence referred to in paragraphs (a) and (b) and sworn to or affirmed by the person submitting the evidence.

(3) A record of service in the Canadian Forces or any form prescribed by the Minister under the Act shall not be considered as evidence relating to proof of age.

(4) A participant shall, upon demand by the Minister, file evidence as to proof of age.

Elections

50 Every election made by a person pursuant to section 62 of the Act shall be made by him in writing, in the form prescribed by the Minister, signed by the person making the election, and the original thereof shall be delivered or sent by registered mail to the Minister within the time prescribed by the Act for the making of such an election.

- SOR/92-717, s. 10

Effective Dates of Becoming and Ceasing to be a Member of the Regular Force

51 For the purposes of Part II of the Act,

(a) the effective date upon which a person becomes a member of the regular force is,

(i) subject to subparagraph (ii), the day he enrols in that force,

(ii) where, for personal reasons, an officer or man is granted leave without pay and allowances with effect on the day he enrols in that force or on the day immediately following that day, the first day on which he reports for continuous full-time duty after the termination of such leave,

(iii) where he is deemed to have ceased to be a member of that force pursuant to section 44, the day on which he ceases to be absent without authority, and