CUSMA Rules of Origin Regulations (SOR/2020-155)

Full Document:

- HTMLFull Document: CUSMA Rules of Origin Regulations (Accessibility Buttons available) |

- XMLFull Document: CUSMA Rules of Origin Regulations [990 KB] |

- PDFFull Document: CUSMA Rules of Origin Regulations [1514 KB]

Regulations are current to 2025-02-04 and last amended on 2020-07-01. Previous Versions

PART 6Automotive Goods (continued)

Steel and Aluminum

Marginal note:Passenger vehicle, light truck or heavy truck

17 (1) In addition to meeting the requirements of sections 13 to 16 or Schedule 1, a passenger vehicle, light truck or heavy truck is originating only if, during a time period under subsection (7) , at least 70 percent by value of the vehicle producer’s purchases at the corporate level in the territories of one or more of the CUSMA countries of steel and aluminum listed in Table S are of originating goods.

Marginal note:Automotive parts

(2) For the purposes of subsection (1), only the value of the steel or aluminum listed in Table S that is used in the production of the part will be taken into consideration for a part of subheading 8708.29 or 8708.99 listed in Table S.

Marginal note:Application

(3) Subsection (1) applies to steel and aluminum purchases made by the producer of passenger vehicles, light trucks or heavy trucks, including purchases made directly by the vehicle producer from a steel producer and purchases by the vehicle producer from a steel service centre or a steel distributor. It also applies to steel or aluminum covered by a contractual arrangement in which a producer of passenger vehicles, light trucks or heavy trucks negotiates the terms under which steel or aluminum will be supplied to a parts producer by a steel producer or supplier selected by the vehicle producer, for use in the production of parts that are supplied by the parts producer to a producer of passenger vehicles, light trucks or heavy trucks. Such purchases must also include steel and aluminum purchases for major stampings that form the “body in white” or chassis frame, regardless of whether the vehicle producer or parts producer makes such purchases.

Marginal note:Other uses

(4) Subsection (1) applies to steel and aluminum purchased for use in the production of passenger vehicles, light trucks or heavy trucks. Subsection (1) does not apply to steel and aluminum purchased by a producer for other uses, such as the production of other vehicles, tools, dies or moulds.

Marginal note:Steel — originating

(5) For the purpose subsection (1), as it applies to a steel good set out in Table S, a good is originating if

(a) beginning on July 1, 2020 and ending on June 30, 2027, the good satisfies the applicable requirements established in section 13 or Schedule 1 and all other applicable requirements of these Regulations; and

(b) beginning on July 1, 2027 the good satisfies all other applicable requirements of these Regulations, and provided that all steel manufacturing processes occur in one or more of the CUSMA countries, except for metallurgical processes involving the refinement of steel additives.

Such steel manufacturing processes include the initial melting and mixing and continues through the coating stage. This requirement does not apply to raw materials of used in the steel manufacturing process, including iron ore or reduced, processed, or pelletized iron ore of heading 26.01, pig iron of heading 72.01, raw alloys of heading 72.02 or steel scrap of heading 72.04.

Marginal note:Value of steel and aluminum

(6) A vehicle producer must calculate the value of steel and aluminum purchases in subsection (1) using

(a) for steel or aluminum imported or acquired in the territory of a CUSMA country,

(i) the price paid or payable by the producer in the CUSMA country where the producer is located,

(ii) the net cost of the material at the time of importation, or

(iii) the transaction value of the material at the time of importation; and

(b) for steel or aluminum that is self-produced,

(i) all costs incurred in the production of materials, which includes general expenses, and

(ii) an amount equivalent to the profit added in the normal course of trade or equal to the profit that is usually reflected in the sale of goods of the same class or kind as the self-produced material that is being valued.

Marginal note:Calculation period

(7) For the purposes of subsection (1), the producer may calculate the purchases made

(a) over the previous fiscal year of the producer;

(b) over the previous calendar year;

(c) over the quarter or month to date in which the vehicle is exported;

(d) over the producer’s fiscal year to date in which the vehicle is exported; or

(e) over the calendar year to date in which the vehicle is exported.

Marginal note:Estimates

(8) If the producer chooses to base a steel or aluminium calculation on paragraph (7)(c), (d) or (e), that calculation may be based on the producer’s estimated purchases for the applicable period.

Marginal note:Option for calculation

(9) For the purposes of subsection (1), the producer may calculate the purchases on the basis of

(a) all motor vehicles produced in one or more plants in the territory of one or more CUSMA countries;

(b) all motor vehicles exported to the territory of one or more CUSMA countries;

(c) all motor vehicles in a category set out in subsection 16(1) that are produced in one or more plants in the territory of one or more CUSMA countries; or,

(d) all motor vehicles in a category set out in subsection 16(1) exported to the territory of one or more CUSMA countries.

Marginal note:Different periods

(10) The producer may choose different periods for the purposes of its steel and aluminium calculations.

Marginal note:Year end analysis

(11) If the producer of a passenger vehicle, light truck, or heavy truck has calculated steel or aluminum purchases on the basis of estimates before or during the applicable period, the producer must conduct an analysis at the end of the producer’s fiscal year of the actual purchases made over the period with respect to the production of the vehicle. If the passenger vehicle, light truck, or heavy truck does not satisfy the steel or aluminum requirement on the basis of the actual purchases, the purchaser must immediately inform any person to whom the producer has provided a certification of origin for the vehicle or a written statement that the vehicle is an originating good that the vehicle is a non-originating good.

Labour Value Content

Marginal note:LVC requirements — passenger vehicles

18 (1) In addition to the requirements in sections 13 to 17 and Schedule 1, a passenger vehicle is originating only if the vehicle producer certifies that the passenger vehicle meets an LVC requirement of

(a) 30%, consisting of at least 15 percentage points of high-wage material and labour expenditures, no more than 10 percentage points of technology expenditures and no more than 5 percentage points of high-wage assembly expenditures, beginning on July 1, 2020 and ending on June 30, 2021;

(b) 33%, consisting of at least 18 percentage points of high-wage material and labour expenditures, no more than 10 percentage points of technology expenditures and no more than 5 percentage points of high-wage assembly expenditures, beginning on July 1, 2021 and ending on June 30, 2022;

(c) 36%, consisting of at least 21 percentage points of high-wage material and labour expenditures, no more than 10 percentage points of technology expenditures and no more than 5 percentage points of high-wage assembly expenditures, beginning on July 1, 2022 and ending on June 30, 2023; and

(d) 40%, consisting of at least 25 percentage points of high-wage material and labour expenditures, no more than 10 percentage points of technology expenditures and no more than 5 percentage points of high-wage assembly expenditures, beginning on July 1, 2023.

Marginal note:LVC requirement — light trucks or heavy trucks

(2) In addition to the requirements set out in sections 13 through 17 and Schedule 1, a light truck or heavy truck is originating only if the vehicle producer certifies that the truck meets an LVC requirement of 45%, consisting of at least 30 percentage points based on high-wage material and labour expenditures, no more than 10 percentage points based on technology expenditures and no more than 5 percentage points based on high-wage assembly expenditures.

Marginal note:Calculation of LVC requirement

(3) For purposes of an LVC calculation for a passenger vehicle, light truck or heavy truck, a producer must include

(a) an amount for high-wage materials used in production;

(b) an amount for high-wage labour costs incurred in the assembly of the vehicle;

(c) an amount for high-wage transportation or related costs for shipping materials to the location of the vehicle producer, if not included in the amount for high-wage materials;

(d) a credit for technology expenditures; or

(e) a credit for high-wage assembly expenditures.

Marginal note:High wage materials

(4) The amount that may be included for high-wage materials used in production is the net cost or the annual purchase value of materials that undergo production in a qualifying-wage-rate production plant and that are used in the production of passenger vehicles, light trucks or heavy trucks in a plant located in the territory of a CUSMA country.

Marginal note:Certification periods

(5) A plant engaged in the production of vehicles or parts may be certified as a qualifying wage-rate vehicle assembly plant or a qualifying-wage-rate production plant based on the average wage paid to direct production workers at the plant from July 1, 2020 until December 31, 2020 or from July 1, 2020 until June 30, 2021. In subsequent periods, the certification of a qualifying-wage-rate production plant based on a period less than 12 months is valid for the following period of the same length. The certification of a qualifying-wage-rate production plant based on a 12-month period is valid for the following 12 months.

Marginal note:LVC calculation

(6) For the purpose of meeting the LVC requirement a producer must use one of the following formulas:

(a) the requirement based on net cost is determined by the formula

LVC = (((HWLC + HWM) ) ÷ NC X 100) + HWTC + HWAC

where

- HWLC

- is the sum of the high-wage labour costs incurred in the assembly of the vehicle;

- HWM

- is the sum or the high-wage material expenditures used in production;

- NC

- is the net cost of the vehicle;

- HWTC

- is the credit for high-wage technology expenditures; and

- HWAC

- is the credit for high-wage assembly expenditures.

(b) the requirement based on total annual purchase value is determined by the formula

LVC = (((APV + HWLC) ) ÷ ((TAPV + HWLC)) X 100) + HWTC + HWAC

where

- APV

- is the annual purchase value of high-wage material expenditures;

- HWLC

- is the sum of the high-wage labour costs incurred in the assembly of the vehicle which may be included in the numerator at the choice of the producer and, if included, must also be included in the denominator;

- TAPV

- is the total vehicle plant assembly annual purchase value of parts and materials for use in the production of the vehicle;

- HWTC

- is the credit for high-wage technology expenditures; and

- HWAC

- is the credit for high-wage assembly expenditures.

Marginal note:High-wage material expenditures

(7) The high wage material expenditures is calculated by adding the APV or net cost, depending on the formula used, of

(a) a self-produced high-wage material used in the production of a vehicle;

(b) an imported or acquired high-wage material used in the production of a vehicle;

(c) a high-wage material used in the production of a part or material that is used in the production of an intermediate or self-produced part that is subsequently used in the production of a vehicle; and

(d) a high wage material used in the production of a part or material that is subsequently used in the production of a vehicle.

Marginal note:Recommendation

(8) It is suggested, but not required, that the vehicle producer calculate the high-wage material and labour expenditures in the order described in subsection (7). A vehicle producer need not calculate the elements in paragraph (7)(b) to (d) if the previous element or elements is sufficient to meet the LVC requirement.

Marginal note:High-wage technology expenditures credit

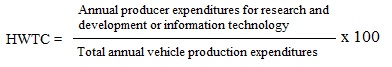

(9) The HWTC is based on annual vehicle producer expenditures at the corporate level in one or more CUSMA countries on wages paid by the producer for research and development or information technology, calculated as a percentage of total annual vehicle producer expenditures on wages paid to direct production workers in one or more CUSMA countries. Expenditures on capital or other non-wage costs for research and development or information technology are not included.

Marginal note:HWTC calculation

(10) The HWTC is determined by the formula

Marginal note:Wages for research and development

(11) For the purposes of subsection (10), expenditures on wages for research and development include wage expenditures on prototype development, design, engineering, testing and certifying operations.

Marginal note:HWAC — passenger vehicles or light trucks

(12) A high-wage assembly credit of five percentage points may be included in the LVC for passenger vehicles or light trucks produced by a producer that operates a high-wage assembly plant for passenger vehicle or light truck parts or has a long-term supply contract for those parts — a contract of a minimum of three years — with such a plant.

Marginal note:HWAC — heavy trucks

(13) A high-wage assembly credit of five percentage points may be included in the LVC for heavy trucks produced by a producer that operates a high-wage assembly plant for heavy truck parts or has a long-term supply contract — a contract with a minimum of three years — for those parts with such a plant.

Marginal note:Minimum number of parts

(14) A high-wage assembly plant for passenger vehicle or light truck parts or for heavy truck parts need only have the capacity to produce the minimum amount of parts specified in the definitions of those terms in section 12. There is no need to maintain or provide records or other documents that certify such parts are originating, as long as information demonstrating the capacity to produce these minimum amounts is maintained and can be provided.

Marginal note:Averaging for LVC requirements

(15) For the purposes of calculating the LVC of a passenger vehicle, light truck or heavy truck, the producer may elect to average the calculation using any one of the following categories, on the basis of either all vehicles in the category or only those vehicles in the category that are exported to the territory of one or more of the other CUSMA countries:

(a) the same model line of vehicles in the same class of vehicles produced in the same plant in the territory of a CUSMA country;

(b) the same class of vehicles produced in the same plant in the territory of a CUSMA country;

(c) the same model line of vehicles or same class of vehicles produced in the territory of a CUSMA country; or

(d) any other category as the CUSMA countries may decide.

Marginal note:Election requirements

(16) An election made under subsection (15) must

(a) state the category chosen by the producer and

(i) if the category referred to in paragraph (15)(a) is chosen, state the model line, model name, class of vehicle and tariff classification of the vehicles in that category and the location of the plant at which the vehicles are produced,

(ii) if the category referred to in paragraph (15)(b) is chosen, state the model name, class of vehicle and tariff classification of the vehicles in that category and the location of the plant at which the vehicles are produced, or

(iii) if the category referred to in paragraph (15)(c) is chosen, state the model line, model name, class of vehicle and tariff classification of the vehicles in that category and the locations of the plants at which the vehicles are produced;

(b) state whether the basis of the calculation is all vehicles in the category or only those vehicles in the category that are exported to the territory of one or more of the other CUSMA countries;

(c) state the producer’s name and address;

(d) state the period with respect to which the election is made, including the starting and ending dates;

(e) state the estimated LVC of vehicles in the category on the basis stated under paragraph (b);

(f) be dated and signed by an authorized officer of the producer; and

(g) be filed with the customs administration of each CUSMA country to which vehicles in that category are to be exported during the period covered by the election, at least 10 days before the day on which the producer’s fiscal year begins or such shorter period as that customs administration may accept.

Marginal note:No recisions or modifications

(17) An election filed for the vehicles referred to in subsection (15) may not be rescinded or modified with respect to the category or basis of calculation.

Marginal note:LVC and net cost

(18) If a producer files an election under paragraph (16)(a), it must include the LVC and the net cost of the producer’s passenger vehicles, light trucks or heavy trucks, calculated under one of the categories set out in subsection (15), with respect to

(a) all vehicles that fall within the category chosen by the producer; or

(b) those vehicles to be exported to the territory of one or more of the CUSMA countries that fall within the category chosen by the producer.

Marginal note:LVC periods

(19) For the purposes of determining the LVC in this section, the producer may base the calculation on

(a) the previous fiscal year of the producer;

(b) the previous calendar year;

(c) the quarter or month to date in which the vehicle is produced or exported;

(d) the producer’s fiscal year to date in which the vehicle is produced or exported; or

(e) the calendar year to date in which the vehicle is produced or exported.

Marginal note:Transportation and related costs

(20) High-wage transportation or related costs for shipping may be included in a producer’s LVC calculation if not included in the amount for high-wage materials. Alternatively, a producer may aggregate such costs within the territories of one or more of the CUSMA countries. Based on this aggregate amount, the producer may attribute an amount for transportation or related costs for shipping for the purposes of the LVC calculation. Transportation or related costs for shipping incurred in transporting a material from outside the territories of the CUSMA countries to the territory of a CUSMA country are not included in this calculation.

Marginal note:Value of materials

(21) The value of both originating and non-originating materials must be taken into account for the purpose of calculating the LVC of a good. For greater certainty, the full value of a non-originating material that has undergone production in a qualifying-wage-rate production plant may be included in the HWM described in subsection (6).

Marginal note:Excess LVC

(22) For the period ending July 1, 2027, if a producer certifies an LVC for a heavy truck that is higher than 45% by increasing the amount of high wage material and manufacturing expenditures above 30 percentage points, the producer may use the points above 30 percentage points as a credit towards the RVC percentages under section 13, provided that the RVC percentage is not below 60%.

- Date modified: